New IRS tables will be in effect until the end of 2025, resulting in taxpayers withholding less tax throughout the year. This could mean that IRS refunds may decrease in 2026, as pointed out on Wednesday by DECO PROTeste.

“With lower monthly tax withholding, there is more disposable income. However, tax adjustments will occur with next year’s IRS declaration. Taxpayers who usually receive an IRS refund may receive a smaller one in 2026, while others might not qualify for a refund and could owe taxes. Conversely, those already paying IRS will likely face a higher bill,” explained the consumer protection organization.

The consumer protection organization notes that “a significant impact was already felt in 2025 regarding the IRS declaration for 2024.”

“Many taxpayers encountered lower refunds or higher amounts to pay. This was because a significant portion of the withholding tax accumulated during the first eight months of 2024 was refunded to employees and pensioners,” added DECO PROTeste.

Furthermore, “for pensioners, this past September, an extraordinary supplement was again granted, which will also be counted as gross income obtained in 2025.”

“Ultimately, employees and some pensioners have fewer accumulated discounts for equal or even higher income compared to the previous year. To determine the IRS owed by taxpayers, the tax authorities consider the year’s income and deduct the discounts made through withholding tax, alongside expenses (such as health and education) and possible tax benefits. If the withheld tax exceeds the owed tax, a refund is due. If it is less, the difference must be paid,” the organization clarified.

Validate invoices throughout the year

DECO PROTeste advises, “It is therefore crucial for taxpayers to always request invoices with a tax identification number (NIF).”

“Periodic validation of invoices on the e-Invoice platform is another habit to adopt, at least monthly. In 2026, the deadline for validating 2025 invoices will be the end of February. Proper tax planning can help mitigate the impact felt in 2026 when paying the IRS,” it states.

Moreover, “To receive alerts for important tax dates, some of which will change next year, and advice to compare scenarios and maximize or minimize IRS payments, access the IRS Simples platform.”

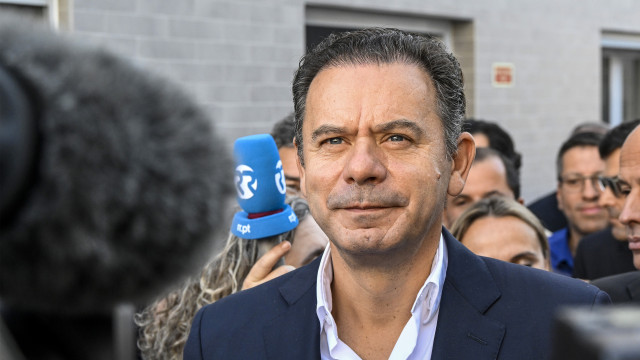

The president of PSD and the prime minister confirmed today that the next State Budget will bring further IRS reductions, citing the results of the recent legislative elections to express confidence in winning in Guimarães.

Lusa | 18:53 – 04/10/2025