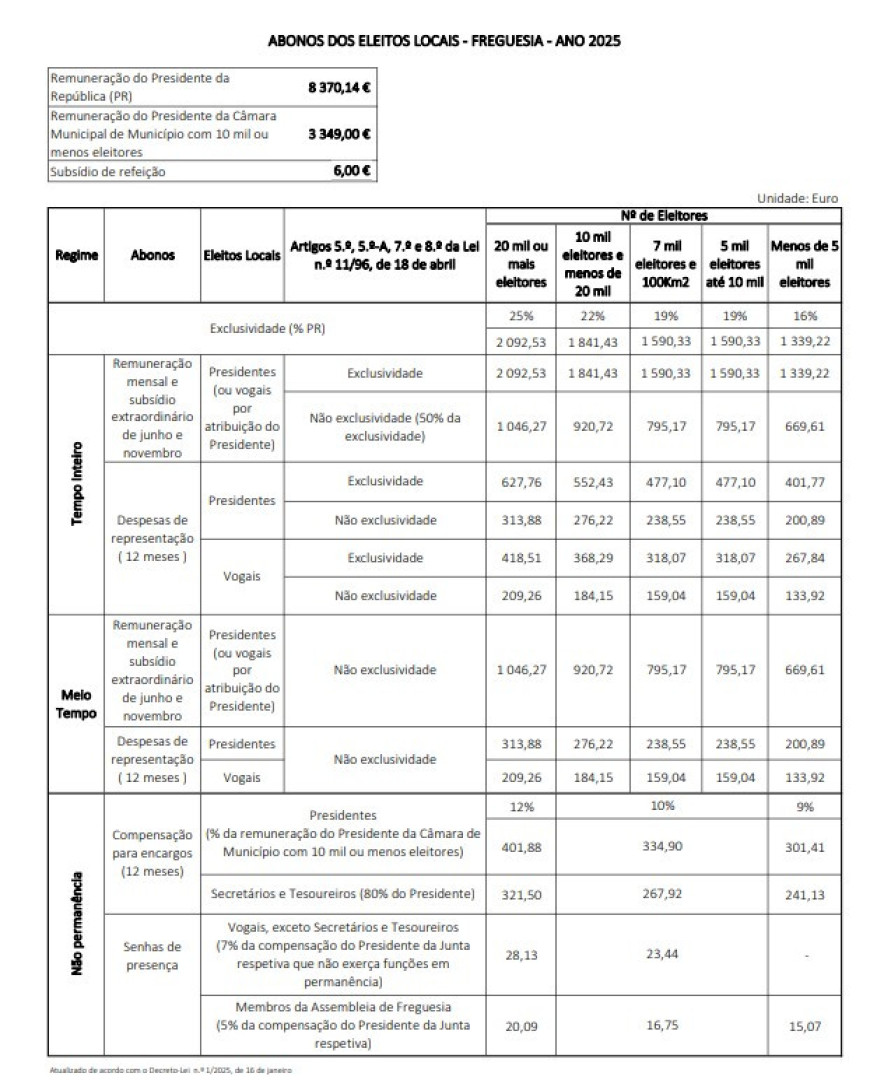

In the upcoming local elections on October 12, voters will select the next presidents of parish councils. While the salaries of municipal leaders have been disclosed previously, there remains curiosity about the earnings of those leading parish councils.

Information available on the Municipal Portal, updated for 2025, indicates that the salary of parish presidents also depends on the number of registered voters, similar to municipal leaders. This voter number is based on those registered at the last general local elections.

There are five brackets based on voter numbers:

- 20,000 or more voters;

- 10,000 voters and less than 20,000;

- 7,000 voters and 100 km²;

- 5,000 to 10,000 voters;

- Less than 5,000 voters.

The salary also varies depending on whether the role is full-time, part-time, or non-permanent.

Let’s break down the figures:

In the first bracket, a parish president with more than 20,000 voters, working full-time in exclusive service, receives a monthly salary and extraordinary bonuses in June and November amounting to 2,092.53 euros, which represents 25% of the President of the Republic’s salary. 627.76 euros of representation expenses are added to this amount.

For non-exclusive service, the president’s salary is halved to 1,046.27 euros, and representation expenses are 313.88 euros.

Full-time or part-time presidency:

- Full-time

According to the Municipal Portal, in parishes with more than 10,000 voters or parishes with more than 7,000 voters and 100 km² of area, the parish president may serve full-time and is entitled, under Law No. 11/96, to payments from the State Budget, including:

- Remuneration, after monthly charge deductions;

- Representation expenses (12 times annually);

- Two annual extraordinary subsidies equal to the remuneration;

- Social Security contributions – vary according to the local elected official’s employment status (up to 23.75% of salary and representation expenses);

- Meal subsidy.

- Part-time

In other parishes, presidents may serve part-time and are entitled to half the full-time remuneration.

In this case, they are entitled, under Laws No. 11/96 and No. 169/99, to payments from the State Budget covering:

- Remuneration, after monthly charge deductions;

- Representation expenses (12 times annually);

- Two annual extraordinary subsidies equal to the remuneration;

- Social Security contributions – vary according to the local elected official’s employment status (up to 23.75% of salary and representation expenses).