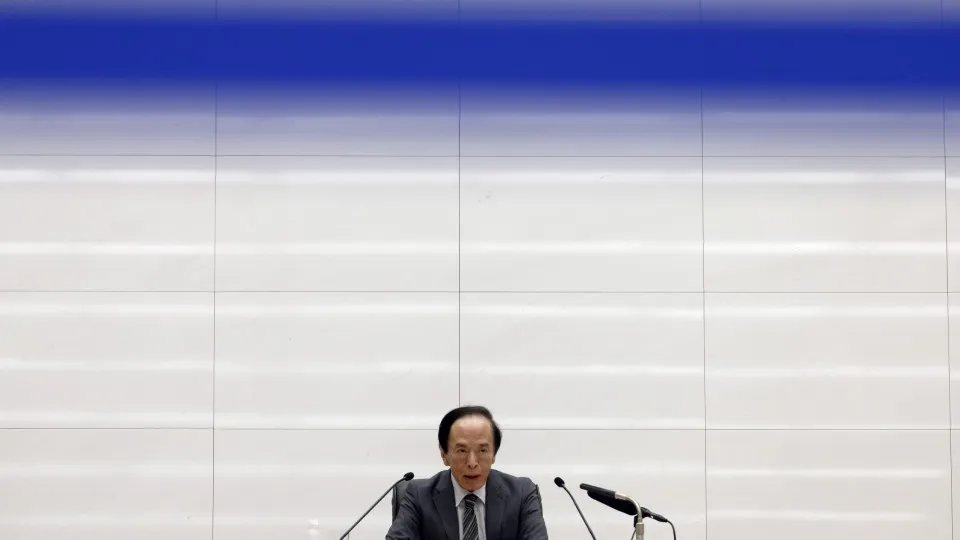

The sales will commence “as soon as the necessary operational preparations are completed,” with an annual amount estimated at 330 billion yen (1.9 billion euros), announced the Bank of Japan (BoJ).

The United States Federal Reserve decided on Wednesday to cut interest rates by 25 basis points, to a range between 4.00% and 4.25%, for the first time since December 2024.

The BoJ also announced the sale of Japanese Real Estate Investment Trusts (J-REITs) it holds at an annual rate of five billion yen (28.8 million euros).

The institution promised to “attempt to sell holdings in ETF [exchange-traded funds] and J-REIT at appropriate prices, considering the state of financial markets.”

The aim is to avoid, “as much as possible,” incurring losses or destabilizing these assets, stated the BoJ in a communiqué.

The Japanese central bank indicated that the pace of the described sales might be temporarily adjusted or suspended in response to changes in market conditions.

The decision marks a step in the normalization of the BoJ’s monetary policy, which in March 2024 started an adjustment in the purchase of exchange-traded funds and other assets.

BoJ’s holdings had been expanding amid the recent upward trend of Japanese stocks, which reached record levels on the local stock exchange.

The Tokyo Stock Exchange reacted pessimistically to the decision. After the announcement, and two hours before the session ended, its main index, the Nikkei, was falling by about 1%, after opening to the rhythm of another historic day.

At the end of the monthly meeting, the monetary policy board of the Japanese central bank opted, by seven votes to two, to maintain interest rates to closely examine the impact of the U.S. rate reduction.

“The Japanese economy has recovered moderately, although some weakness has been evident,” stated the BoJ, adding that there are several risks to the economic outlook, mainly due to external factors.

“In particular, how trade and other policies will evolve in each jurisdiction and how economic activity and international prices will react to these remains highly uncertain,” emphasized the central bank.

In this situation, the institution added, “it is necessary to pay close attention to the impact of these developments on financial and foreign exchange markets, as well as on economic activity and prices in Japan.”