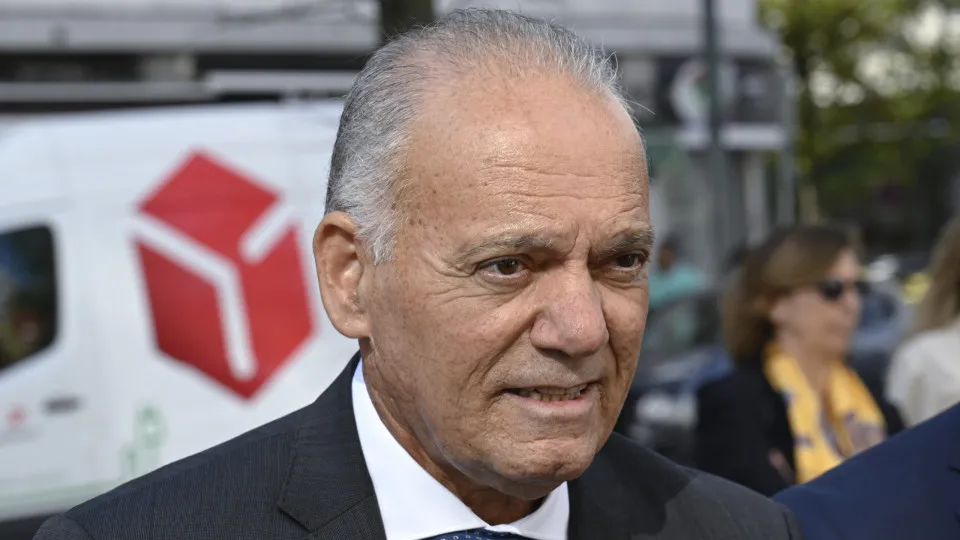

The initial public offering (IPO) for Banco de Fomento Angola (BFA) is progressing well and is expected to take place in July, according to João Pedro Oliveira e Costa. He made this announcement during a press conference in Lisbon, where he presented the bank’s first-quarter results, which showed profits of 137 million euros.

The preparation for the IPO, involving BPI and Unitel—BFA’s two main shareholders—is reportedly going smoothly. Oliveira e Costa emphasized strong alignment between the two entities but noted that there have been no talks with potential investors yet. The sale price for the bank has not been finalized, and the investor roadshow has yet to commence.

The ownership of BFA currently stands at 51.9% by Unitel, a state-owned Angolan telecom operator that was nationalized in 2022, and 48.1% by BPI. Since 2017, the European Central Bank (ECB) has recommended that BPI decrease its exposure to Angola, citing non-equivalent supervisory standards compared to Europe.

Oliveira e Costa disclosed that 29.75% of BFA stock is slated to be sold in July, with Unitel and BPI selling 15% and 14.75%, respectively. BPI has valued its share of 14.75% at 95 million euros, based on BFA’s total valuation of 650 million euros.

The BPI head expressed optimism that the 14.75% share could be sold above book value, citing the bank’s strong performance and reputation in Africa. Post-sale, BPI’s remaining 33% stake in BFA is expected to satisfy the ECB’s comfort levels, although further stakes might be divested if there is market interest. According to Oliveira e Costa, the Angolan government’s efforts, along with responsible banking operations, have mitigated supervisory concerns.

Despite a reduced stake, BPI will retain significant influence at BFA. An agreement with Unitel and the Angolan government ensures that any changes in statutes, dividend policies, or governance require BPI’s consent. Oliveira e Costa stressed the importance of this authority to protect shareholder interests and potentially attract new investors.

The planned sale will occur on the Luanda stock exchange and is poised to be its largest transaction to date. Oliveira e Costa remarked that this offers significant opportunities to potential investors.

BPI announced its quarterly profits reached 137 million euros, marking a 13% increase compared to the same period last year. The boost in profits is attributed to the dividends from BFA amounting to 46 million euros for 2024, despite a 9% decline in net interest income to 223 million euros. In Portugal, profits decreased by 13% year-on-year, totaling 98 million euros.