The Portuguese Business Confederation (CIP) expressed concerns over the projected 4.5% increase in expenditure outlined in the proposed State Budget for 2026 (OE2026) and the downward revision of the country’s economic growth.

The confederation, headed by Armindo Monteiro, highlighted, “Our country has experienced almost anemic growth rates, consistently falling short of our potential, yet showing significant increases in current expenditure.” It emphasizes the need for “more vigorous measures” to boost productivity, sophisticate the business landscape, and enhance the economy with “new competitive factors.”

CIP also notes an “erosion of net wages” following the update to IRS tax brackets, arguing that it falls “below what is necessary” to “ensure fiscal neutrality” and describes the rate reductions as “timid.”

The new table proposed by the Government includes a reduction in IRS rates between the 2nd and 5th brackets, with a 3.51% update in the values defining each IRS bracket.

CIP states, “The OE2026 proposal requires determination in implementing the State Reform to ensure public interest services are delivered with higher quality while consuming a smaller portion of resources produced by the economy.” It also calls for efforts in achieving public investment, as execution in recent years has “fallen far short of budgeted values.”

On a positive note, CIP welcomes the 6.8% increase in public investment, “raising its share in the economy from 3.3% to 3.4%,” alongside the easing of the tax burden, although carried out “very slowly,” and the “continuation of the trajectory to reduce public debt, albeit at the cost of increasing revenue rather than cutting expenses.”

The business confederation hopes that during the specific discussions or alongside the OE2026, it will be possible to propose other measures, such as the General Regime of Fees and Contributions, a simplified tax regime for micro-enterprises, which “also includes a profound simplification of all administrative and accounting obligations that burden small businesses,” and implementing a “15th month without its current limitations,” it argues.

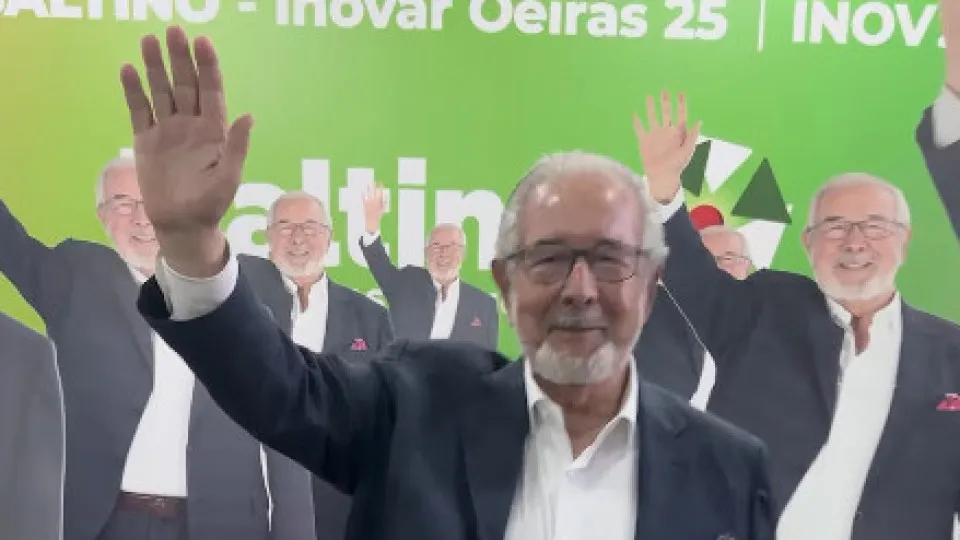

The Government submitted the OE2026 to parliament today, just before the deadline and three days before Sunday’s municipal elections.

In the macroeconomic scenario, the PSD/CDS-PP Government forecasts GDP growth of 2% this year and 2.3% in 2026.

The executive aims to achieve surpluses of 0.3% of GDP in 2025 and 0.1% in 2026. As for the debt ratio, it is projected to decrease to 90.2% of GDP in 2025 and 87.8% in 2026.

The proposal will be discussed and voted on in general from October 27 to 28, with the final global vote set for November 27, following the detailed debate process.