The markets and analysts anticipate the European Central Bank (ECB) will maintain the bank deposit rate at 2%, a level considered neutral for the eurozone, meaning it neither stimulates nor hinders economic growth.

This ECB meeting follows the recent fall of a government in France on Monday and the escalation of conflicts involving Russia in Ukraine, with an attack on Poland, and in the Middle East, following an Israeli attack on Qatari territory.

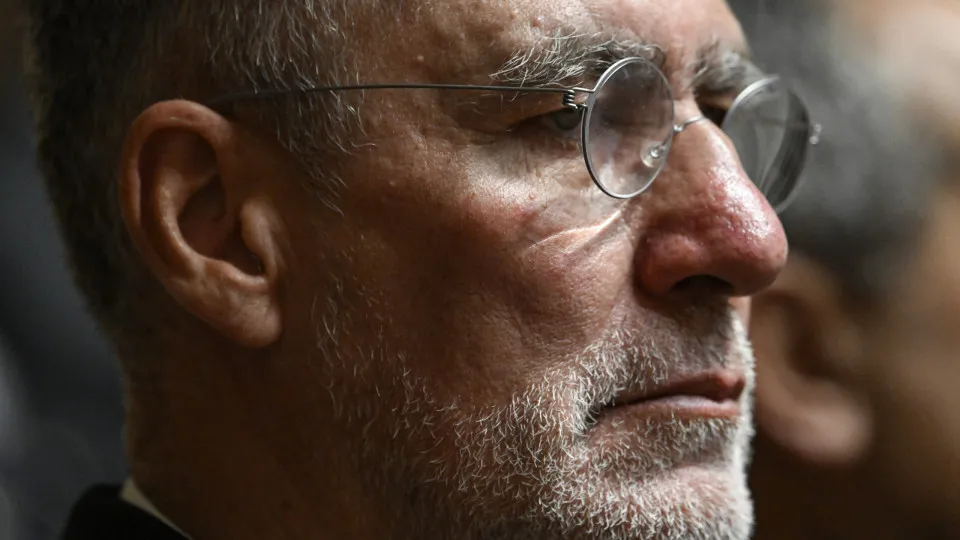

Luke Bartholomew, Deputy Chief Economist at Aberdeen Investments, noted that given the near certainty of unchanged rates from the ECB, “the main questions for investors will be what signals the ECB gives about the future path of rates and how its policy might interact with the unfolding political situation in France.”

Martin Wolburg, Senior Economist at Generali AM, believes the disinflation process continues and expects overall inflation to stabilize below 2%.

Bartholomew argues, “The rate-cutting cycle has ended, and if there is any change, the more likely scenario is a hike rather than a cut, although this is expected to occur in the distant future when Europe’s fiscal easing begins to take effect.”

The eurozone’s growth remains weak but may recover in the fourth quarter due to Germany’s fiscal stimulus, the impact of ECB rate cuts, and some recovery in the industrial sector, though this outcome is uncertain.

The trade agreement between the US and the European Union (EU) has reduced a factor of uncertainty, but Russia’s war against Ukraine has intensified after the attack on Poland, as has the situation in the Middle East following the Israeli attack on Qatari territory.

Political turmoil in France persists due to the rejection of budget adjustments, maintaining a deficit of about 5% of GDP since 2010.

Each French citizen faces an annual deficit of 2,400 euros and a debt of 55,000 euros, according to economist Friedrich Heinemann from the Centre for European Economic Research (ZEW), who is also a professor at the University of Heidelberg in western Germany.

The rejection of 44 billion euros in budget cuts led to the fall of François Bayrou’s government, which will be replaced by Defence Minister Sébastien Lecornu.

France has been in a state of significant political instability for some time, having appointed five prime ministers in less than two years amid violent street protests.

“France should save more than Bayrou had established. If the public and politicians in France deny these realities, it will be dangerous, also for the ECB,” said Heinemann, emphasizing the risk involved for the euro’s stability and Europe’s solvency.

For now, however, market reactions have been subdued, likely predicting ECB intervention through purchasing French sovereign debt on the secondary market should the French risk premium rise, despite France having an ongoing deficit procedure.

On Tuesday, the euro approached $1.18 before falling back to $1.17, although expectations have risen that the Federal Reserve (Fed) will cut its interest rates by 50 basis points next week, due to a weaker-than-expected labor market.

The ECB is set to release new macroeconomic forecasts for inflation and growth. In June, ECB economists projected growth of 0.9% in 2025, 1.1% in 2026, and 1.3% in 2027, with an inflation rate of 2% in 2025, 1.6% in 2026, and 2% in 2027.