“We expect the ECB to cut interest rates by 25 basis points at its meeting on June 5, marking its eighth reduction in this cycle, bringing the deposit rate to 2.0%,” states Michael Krautzberger, Head of Investment in Public Markets at Allianz Global Investors, in an analysis note.

The analyst notes that “although concerns about a global trade war have diminished” since the central bank’s last meeting in April, “trade tensions persist.”

Meanwhile, available data for the eurozone “continues to indicate weak economic activity and moderate inflationary pressures in the region”: “We believe the ECB will exercise caution given the downside risks to growth in its June monetary policy statement,” he maintains.

Similarly, senior economist at Generali Investments, Martin Wolburg, believes that “the risks from the trade war justify further easing” by the central bank, anticipating another 25 basis point cut, but noting that “the room for further rate cuts is narrowing.”

“At 2.25%, the interest rate has already reached the upper limit of the neutral range of 1.75% to 2.25% calculated by the ECB team. While in neutral territory, the room for further rate cuts is diminishing. However, we do not yet see the end of the cutting cycle,” reads a note released today.

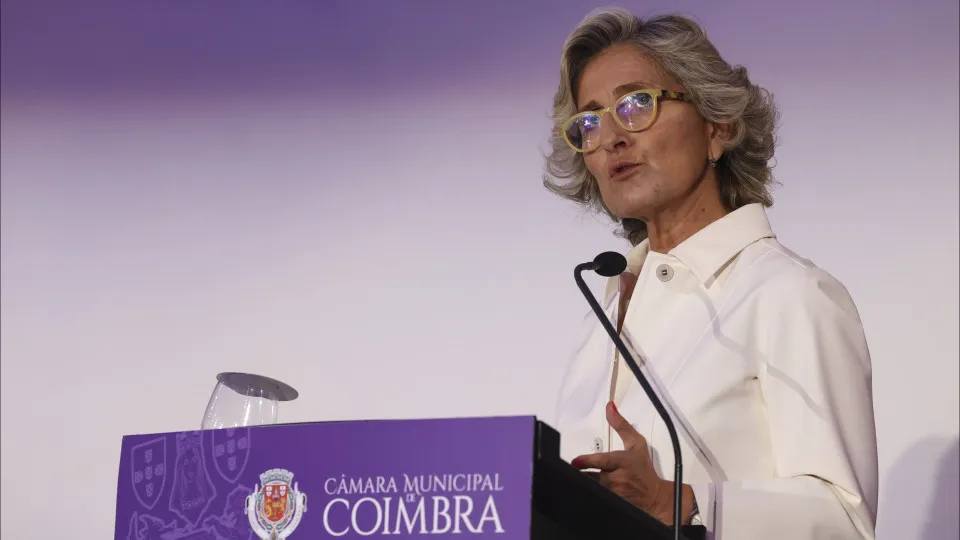

Although he continues to point to a future new rate cut to 1.75%, Martin Wolburg predicts that ECB President Christine Lagarde “should emphasize data dependency and deliberately leave the timing of the final cut open.”

In a similar vein, analysts at Ebury assert that a 25 basis point cut “is fully priced in by the markets,” and therefore should not impact the euro’s exchange rate.

For Ebury’s Head of Market Strategy and senior market analyst, Matthew Ryan and Roman Ziruk, market focus is on “analyzing the tone of communications” from the ECB, particularly President Lagarde’s press conference, “for clues on the pace and extent of future monetary policy easing.”

However, they anticipate that, as usual, Christine Lagarde “will keep her cards close to her chest,” with the central bank waiting for upcoming data and trade developments before deciding the next step.