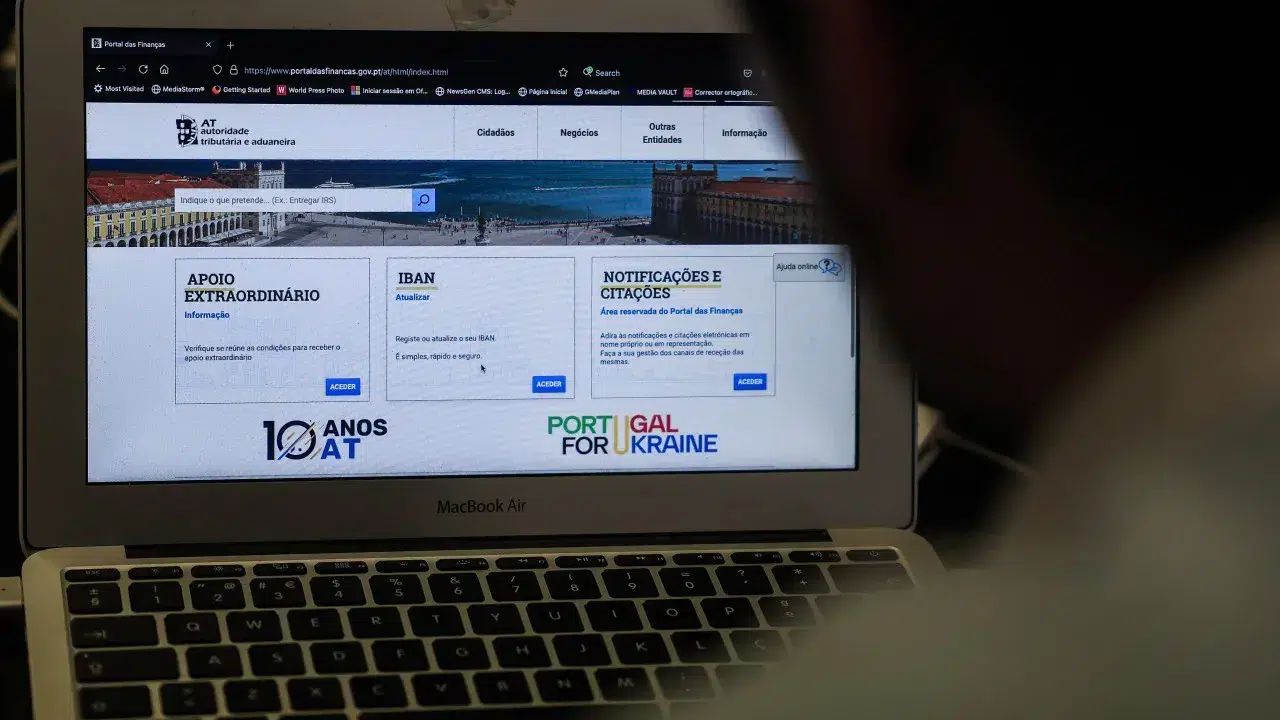

The Tax and Customs Authority (AT) announced that from today, foreign citizens can submit requests through two methods: digitally via the e-balcão function or through in-person service with prior appointment.

Foreign citizens, who cannot authenticate on the Finance Portal to submit requests on e-balcão, must have these tasks handled by a legal representative. This representative, who must hold power of attorney, can be a lawyer or solicitor, in which case signature recognition on the power of attorney is not necessary.

To proceed with the request, the representative should visit the e-balcão service and select “register new issue.” In the “tax or area” field, choose the penultimate option named “taxpayer registration.” For the “type of issue,” select “Identification.” Lastly, choose the fifth option under “issue,” which reads “Assign/Change NIF-Individuals.”

After this, the request is made, and the necessary documents are attached.

According to an AT informational leaflet, three documents are needed: a copy of the “civil identification document, specifically the passport of the citizen to be registered”; a “document showing the foreign address, unless it is included in the identification document”; and the “civil identification document of the legal representative and the necessary power of attorney.” The Finance Portal allows the compacting of several documents into one.

Alternatively, those wishing to handle these procedures in person at a tax office or citizen shop must book an appointment in advance, which can be done on the Finance website or through AT’s telephone service.

Online appointment requests can be made on the “contacts” page, without requiring personal portal authentication; for phone bookings, call 217 206 707.

The AT website offers a leaflet with more details in Portuguese, English, and French on how citizens should proceed.

In a statement released today, the AT explains these functions, aimed at foreign citizens, are designed to “facilitate the quality of service” provided by the Finance services.

According to AT, taxpayer registration “is mandatory for all citizens, national or foreign, resident or non-resident, who are subject to tax obligations or wish to exercise their rights with the AT.”

Obtaining the NIF is “essential for many daily activities, not only related to taxes but also with employment, contracts, bank account openings, and Social Security,” the AT notes.