Tax expert Magda Canas stated that with the adjustment of withholding tax tables, “taxpayers will advance less money to the State in their monthly deductions,” making it “very likely they will receive less in 2026.”

“During this year’s IRS filing period, many taxpayers were surprised because they had to pay more IRS than expected or did not receive the refunds they were accustomed to for covering extra expenses,” notes Deco Proteste.

She explained, “This happened because less tax was withheld throughout 2024,” noting “the same may occur in 2025, affecting refunds or additional payments in 2026.”

The Council of Ministers approved a draft law on Wednesday for an additional reduction in the IRS amounting to 500 million euros, applicable this year, which has been submitted to Parliament.

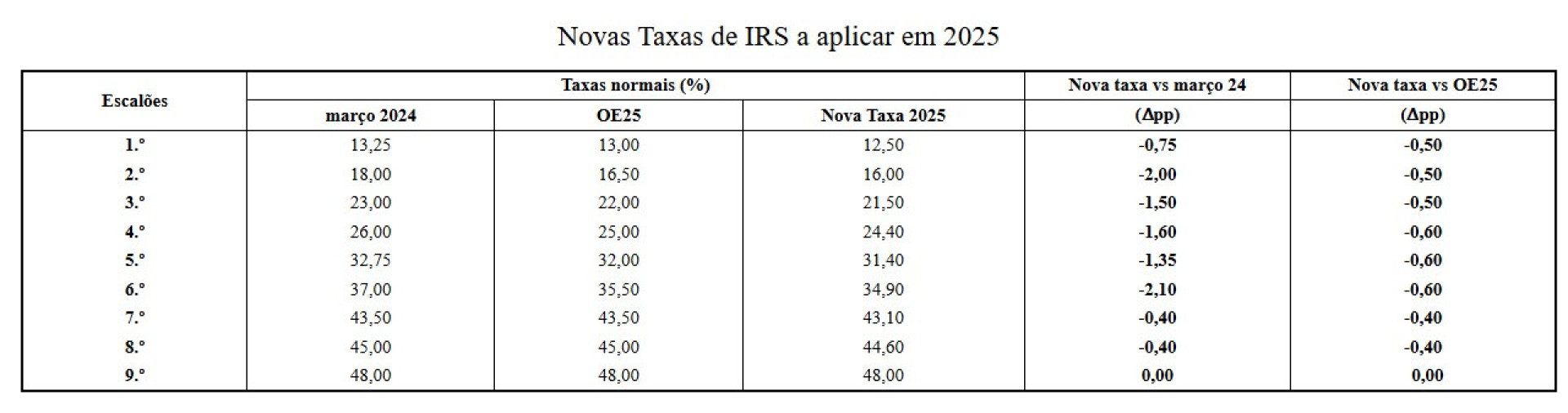

In a statement, the Council of Ministers highlighted that the approved proposal “allows for a new relief of the tax burden, further reducing marginal rates across all brackets, up to the 8th bracket.”

The Government’s proposal includes decreases in IRS rates of 0.5 percentage points between the first and third brackets, 0.6 points between the fourth and sixth, and 0.4 points in the seventh and eighth.

“We are talking about a reduction of IRS rates in the first eight brackets, essentially, those earning up to 83,000 euros per year, slightly more, will feel some relief,” stated Magda Canas, noting that it is “the middle brackets, between the fourth and sixth,” that will benefit the most, with higher incomes above the ninth bracket “left out.”

Deco Proteste’s expert specifies that “the Government estimates savings could range from 34 euros to over 400 euros per year, depending on income levels, giving the example of a couple with two salaries of 1,500 euros per month, who could save around 165 euros compared to what was projected at the start of this year.”

Comparing with what they paid before March 2024, the savings are “nearly 700 euros.”

For Magda Canas, these are “figures that make a difference in the monthly budget, especially during a price increase period” and at a time when, “given the global context, prices are still expected to rise, notably fuel.”

Also noted by the legal and tax affairs specialist is that this proposal is set to take effect “in principle, as it still needs Parliamentary approval” starting September.

“Thus, the new withholding tables come into effect retroactively to January, and wages and pensions paid in September and October could indeed reach our bank accounts slightly higher, reflecting this adjustment,” she added.