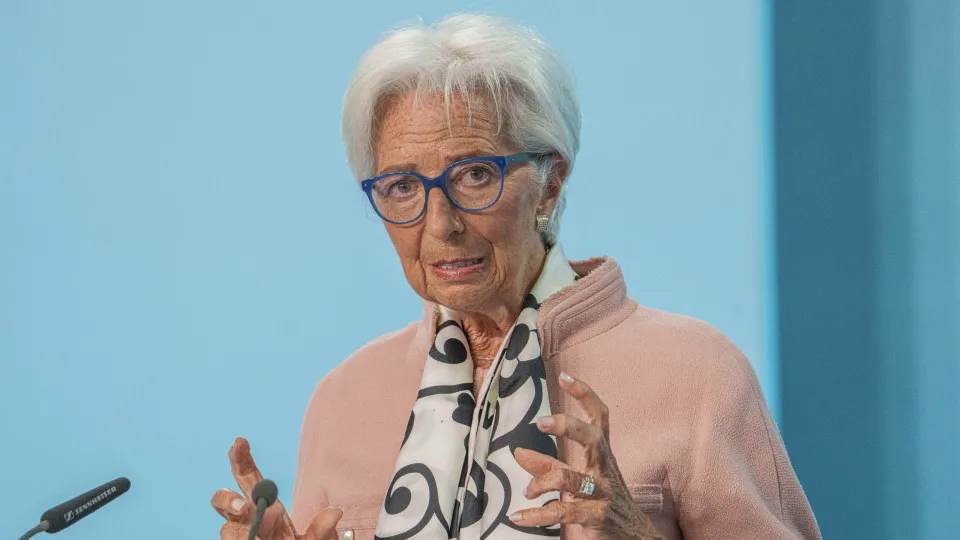

“One of the main structural changes in the financial system over the past two decades has been the growing presence of non-bank financial institutions,” stated Lagarde during the opening session of the ECB’s Annual Research Conference, titled this year “The Next Financial Crisis?”

The ECB leader noted that the non-bank financial sector “is increasingly important in financing the real economy and managing the savings of households and businesses.”

According to the figures presented by Lagarde, investment funds, insurers, money market funds, and securitization vehicles now represent more than 60% of the eurozone’s financial sector.

In her speech, Christine Lagarde reiterated that banks and non-bank financial institutions are highly interconnected.

In the eurozone, the asset exposures of banks to non-bank financial institutions are significant, averaging around 10% of the total assets of the largest banks directly supervised by the ECB.

Lagarde reminded that Europe is sometimes accused of over-regulating, but emphasized that the role of supervision and regulation is to “contain the risks” of innovation or structural transformation.

She stated that Europe will now implement “an ambitious simplification” of community legislation under the direction of the European Commission (EC), while noting that “simplification does not necessarily mean deregulation.”

“It means maintaining resilience with a more effective and efficient supervisory and regulatory framework,” she stressed.

The ECB’s Annual Research Conference, held this year under the theme “The Next Financial Crisis?,” is organized in conjunction with Stanford’s Hoover Institution and brings together policymakers and academics to discuss how current regulations, supervisory practices, monetary policy (both conventional and unconventional), and technological innovations influence financial fragility.