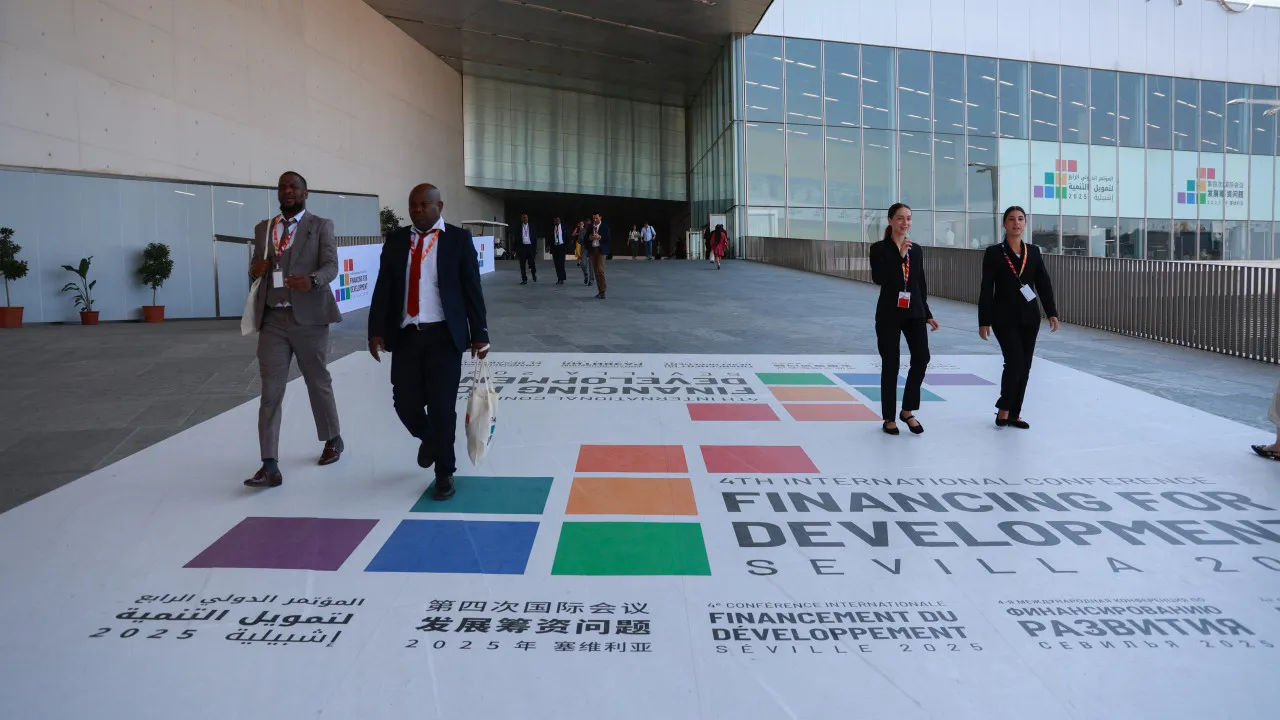

A major initiative was unveiled today in Seville during the Fourth United Nations International Conference on Financing for Development. The presidents of the Inter-American Development Bank (IDB), the European Investment Bank (EIB), and the European Bank for Reconstruction and Development (EBRD) were present at the press conference.

The Alliance also includes the African Development Bank, the Development Bank of Latin America, the Caribbean, and the Asian Development Bank.

The Spanish Minister of the Economy, Carlos Cuerpo, stated that the aim is to generalize the suspension of sovereign debt payment clauses under specific scenarios, similar to existing cases under bilateral agreements.

These clauses temporarily suspend public debt obligations to provide developing countries with greater economic and financial capacity to respond to crises caused by natural disasters, food shortages, or health emergencies.

The goal of the Alliance is for these suspension clauses to be systematically adopted in bilateral, multilateral, and commercial loan agreements.

IDB President Ilan Goldfajn remarked that this is “another step in the right direction” and committed to involving more countries in the Alliance and foreseeing new types of crises in contract clauses.

Nadia Calviño, President of the EIB, also pledged to include these debt suspension clauses in the financing agreements signed within the framework of the European bank.

In addition to this Alliance, the Spanish Minister of the Economy presented another multilateral initiative related to the debts of developing countries, which the international community assembled in Seville (representatives from 192 of the 193 UN countries) acknowledges as a major obstacle to more effective development financing, mobilizing enormous financial resources that should and could be used for poverty reduction projects and development promotion.

The second initiative introduced today in Seville is the “Global Hub for Debt Swaps for Development,” which aims to facilitate and promote programs where public debt is converted into investments for sustainable development in areas such as health, education, and climate change response.

This conversion of debt into development financing is already being carried out by various creditor countries, such as Portugal with Cape Verde, and the platform presented today in Seville seeks to provide technical assistance to governments, standardize documents and rules, and create a coordination space within the framework of existing programs.

The “Global Hub for Debt Swaps for Development” is an initiative by Spain with the World Bank, which will manage a fund to finance the technical assistance for governments. Multilateral agencies, donor countries, banks, and civil society can join, explained the Spanish Minister of the Economy.

The Spanish Government announced a donation of three million euros for the platform’s technical activities and allocated 300 million euros for debt conversion agreements into development investments over the next five years.

According to UN data, the public debt of developing countries reached $31 trillion (€26.5 trillion) in 2024, a year marked by record interest payments totaling $921 billion.

The UN also reports a $4 trillion annual deficit in development financing.