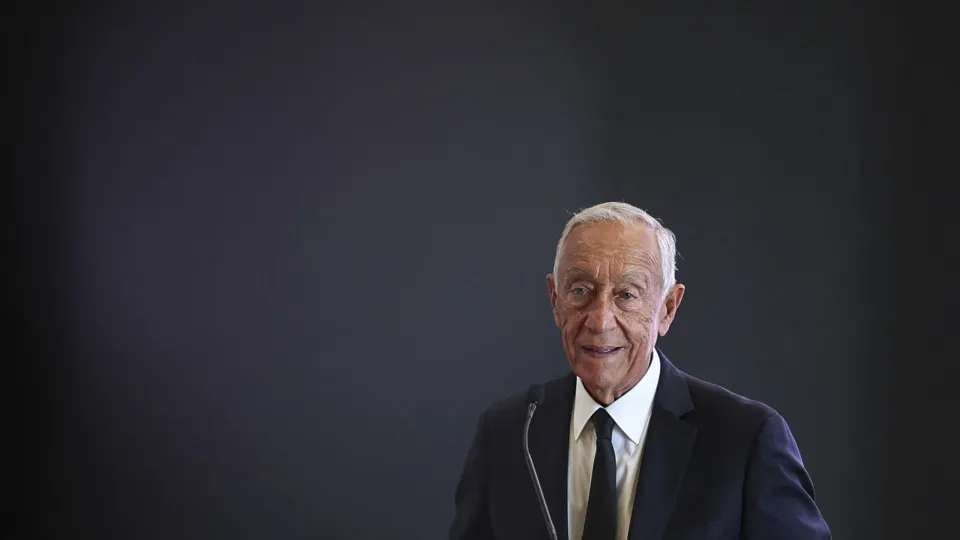

The President of the Republic has officially enacted the bill from the Assembly of the Republic introducing the VAT group regime.

This regime involves the consolidation of VAT balances to be paid or recovered by members of a group of entities linked by financial, economic, and organizational ties, as noted in the presidential statement.

The President enacted the legislation on the day it was passed in parliament during the final vote, based on the government’s proposal to establish a VAT group regime, allowing economic groups to consolidate tax amounts payable or recoverable from the state.

The initiative received support from PSD, CDS-PP, Chega, and IL, while the PCP and BE opposed it. The PS, Livre, PAN, and JPP abstained.

The new regulations will take effect for VAT periods starting on or after July 1, 2026.

The model targets companies within the same economic group, based on consolidating the tax balances to be delivered or recovered by each group company, detailed in the initiative’s explanatory text.

To qualify, companies must be closely connected through financial, economic, and organizational ties, as the government outlines in the proposal’s rationale.

The consolidation is carried out in a VAT declaration provided by the Tax and Customs Authority and confirmed by the group’s controlling entity, or the parent company, according to the initiative’s details.

The proposal specifies that group companies continue submitting their periodic declarations, determining their balances, which are then accounted for in the group declaration.

The consolidation process does not alter the regular activities of the VAT group members, who will continue to charge tax on their active operations and deduct tax on passive ones, regardless of whether these occur internally or with third parties, as further explained in the initiative.

The government stated the proposal was drafted considering the experience in taxing corporate groups in corporate tax and contributions from the Large Taxpayers Forum, a dialogue group between the Tax and Customs Authority and major national companies.