The parliament has enacted decrees implementing three European regulations, notably the European Market in Crypto-assets Regulation (MiCA), approved in 2023, which had not yet been applied in Portugal.

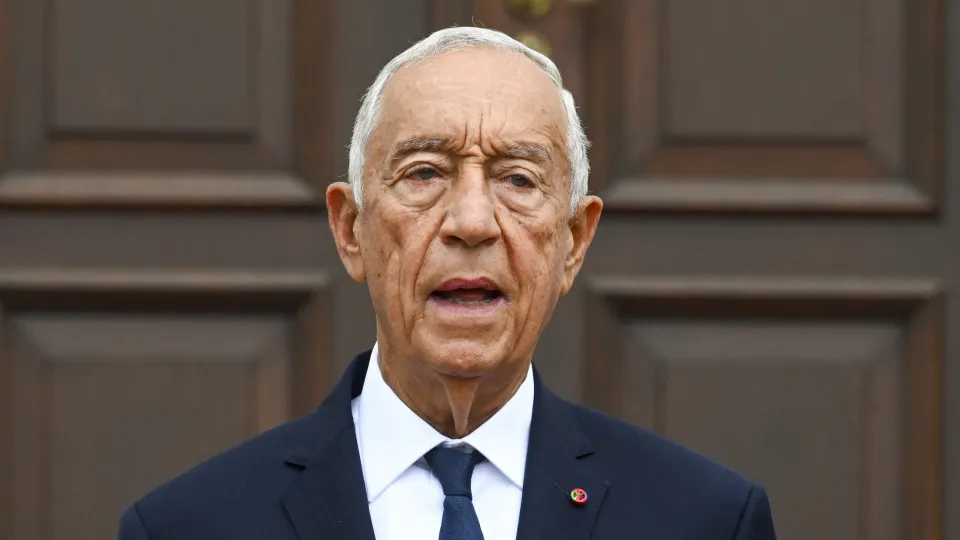

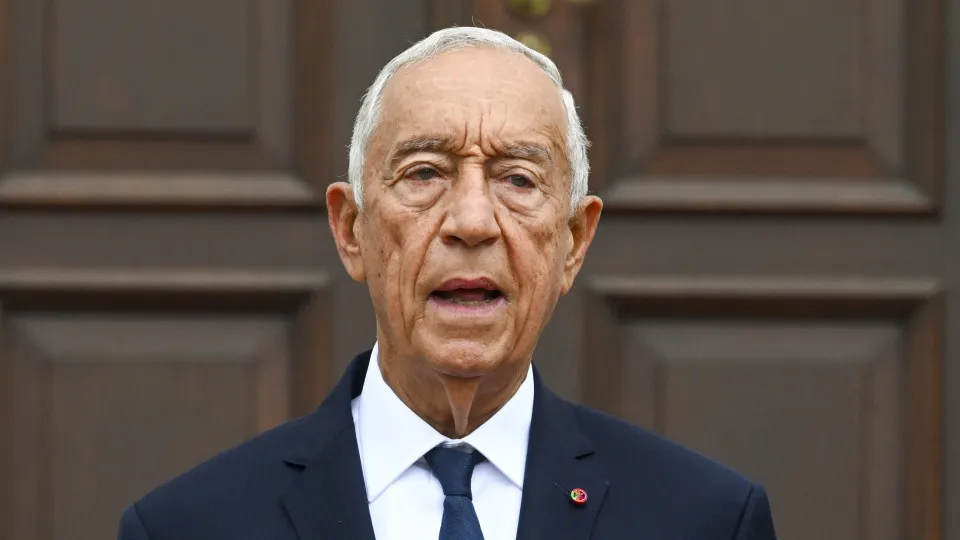

In an official statement from the Presidency of the Republic, Marcelo Rebelo de Sousa noted that “cryptocurrencies raise various concerns regarding their nature, function, taxation, systemic risks, and the effectiveness of regulatory control.”

“The European Commission itself deems the existing European oversight inadequate prior to strengthening the role of the European Securities and Markets Authority (ESMA) as a centralized supervisory body,” it reads.

Marcelo Rebelo de Sousa expressed that he shares “a significant portion of these concerns” and enacted the three parliamentary decrees for three reasons: “to prevent Portugal from being penalized for not implementing European regulations; maintaining even insufficient oversight is better than none; the bills grant powers to the Bank of Portugal and the Securities Market Commission (CMVM), in addition to the European regulations, when necessary.”

These decrees were approved by the Assembly of the Republic on December 5.

The decree aiming to combat money laundering and terrorism financing in operations involving digital assets, transposing into Portuguese law the European regulation 2023/1113, was approved with support from the PSD, CDS-PP, PS, Chega, Livre, PAN, and JPP. The PCP, BE, and IL abstained.

The decree that incorporates the new rules of the European regulation 2023/1114, known as “MiCA,” into Portuguese legislation was approved with favorable votes from the PSD, CDS-PP, PS, Chega, IL, PAN, and JPP. The PCP and BE voted against it. Livre abstained.

The first legislative text adapts the current anti-money laundering rules applicable to the financial sector to crypto-asset transfers.

Starting July 1, 2026, “crypto-asset service providers based in Portugal” with authorization to operate will be considered financial entities for supervision by the Bank of Portugal. They must adhere to the same rules that banks follow to prevent money laundering and terrorism financing.

If financial entities identify a “high risk” of money laundering in fund or crypto-asset transfers, they must “fully understand the flow of funds or crypto-assets” and “all participants” to ensure that “only entities or individuals properly authorized to process” crypto-asset operations are involved.

The second approved proposal complements this initiative. The text defines the authorities responsible for overseeing this sector in Portugal—dividing control between the Bank of Portugal (BdP) and the Securities Market Commission (CMVM)—as well as the cooperation obligations between these two supervisors and, consequently, between these national entities and their respective European supervisors.

During this session, another regulation implementing European regulation 2024/886 on instant credit transfers in euros was also approved and has now been enacted by the President of the Republic. The text was approved by PSD, CDS-PP, PS, Chega, IL, Livre, and JPP. PCP, BE, and PAN abstained.