The Public Prosecutor has charged Mário Ferreira, owner of the Mystic Invest group and Douro Azul, with qualified tax fraud allegedly committed during the 2015 sale of the ship Atlântida to a company established in Malta. The prosecutor claims that this involved a corporate scheme that purportedly allowed the businessman from Porto to gain “illegitimate” IRS benefits exceeding one million euros.

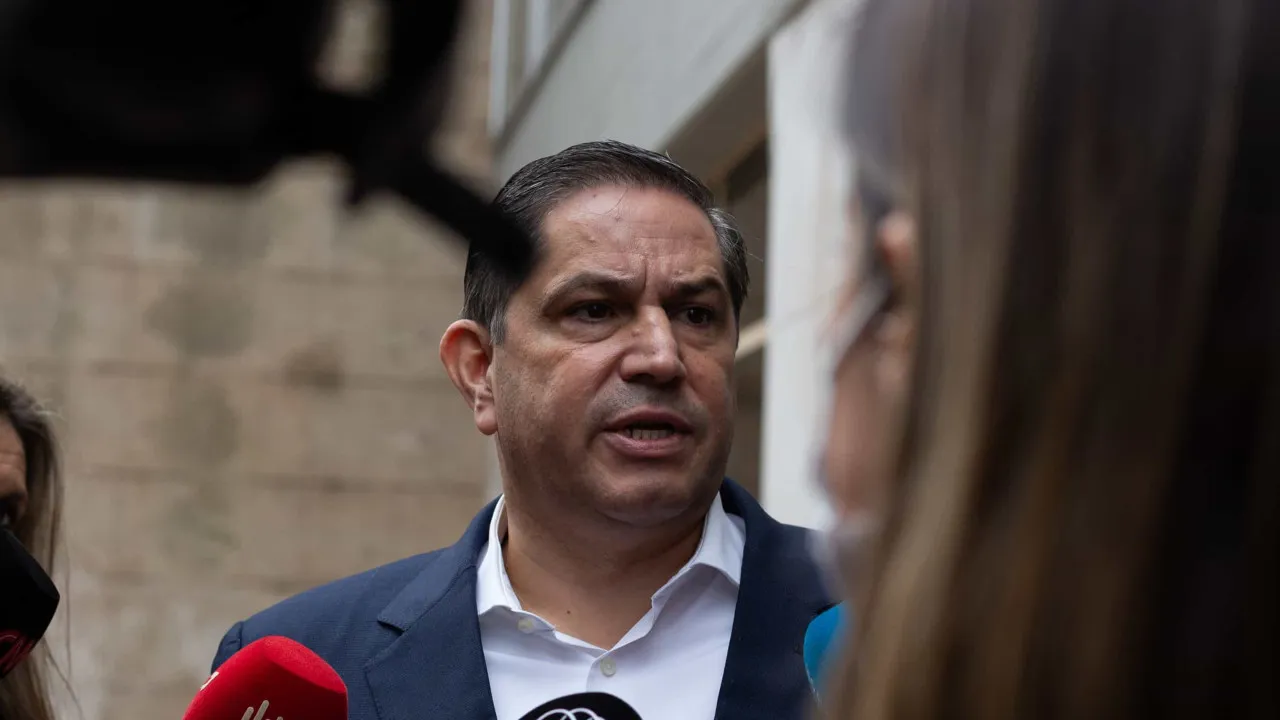

“Not only is this accusation factually and legally unfounded, but it defies common sense and logic, which will undoubtedly be demonstrated in the appropriate forum: the trial. Our client intends to proceed directly to this enlightening and conclusive phase of the process, foregoing instruction,” stated Rui Patrício, Tiago Félix da Costa, and José Maria Montenegro, the lawyers representing the businessman in a joint response sent to the Lusa news agency.

The defense states that the sale of Atlântida was investigated by the Public Prosecutor in at least three criminal proceedings, alleging crimes of passive and active corruption, economic participation in a business, harmful administration, money laundering, and tax fraud.

“It took nine long years to restore the truth. Nine years later, and after everything was investigated down to the smallest detail, it finally became clear that the infamous suspicion of passive and active corruption, economic participation in a business, and harmful administration was completely unfounded and was duly closed by the Public Prosecutor,” the lawyers recall.

The defense argues that, “inexplicably,” the Tax Authority and the Public Prosecutor “were unable to close the criminal process in its entirety, as was just and due,” now having “confronted” their client with a tax fraud accusation concerning IRS.

“This accusation exemplifies what sometimes occurs in the justice system in Portugal. A manifest lack of courage to recognize the total absence of evidence and to simply dismiss a high-profile case, insisting, in this instance, on a final, sole, and unfounded accusation, as the core issue at worst involves technical disagreements between a taxpayer and the tax administration,” the lawyers assert.

According to the defense of the current owner of the Media Capital group, which owns TVI, “the notion of fraud remains concerning unpaid IRS on undistributed earnings (which has been fully paid over the years),” alongside a compensation claim of 110,000 euros “solely in interest, relating to a time when the company itself was unaware of its results.”

“Nonetheless, confronted with this unfounded narrative leftover by the Tax Authority and the Public Prosecutor regarding his IRS (after all, only regarding IRS), our client, against all technical opinions, has already voluntarily paid in full the amount of tax and interest involved, now claimed by the Tax Authority,” the statement reads.

The lawyers express regret that “even after closing all suspicions of passive and active corruption, economic participation in business, harmful administration, and money laundering,” the Public Prosecutor “remains unconvinced that Mário Ferreira never had, nor has, any intention of evading the payment of any tax.”

“And that the operation in question resulted from various vicissitudes unrelated to tax issues, but rather from a persecutory campaign executed and widely publicized by at least the commentator Ana Gomes,” they accuse.

The Public Prosecutor claims that the issue concerns the sale of the ship Atlântida “through the intermediation of a corporate structure established in Malta, which aimed to conceal the real sale values and prevent their taxation in Portugal.”