The new VAT collection model will enable economic groups with multiple companies to consolidate the tax balances they owe to the state or are due to recover from entities “united by financial, economic, and organizational links,” as stated in the new legislation.

The law becomes effective on Tuesday but will only take effect in the next year, applicable “for tax periods starting from July 1, 2026.”

The legal text outlines that the necessary financial linkage is established when the dominant entity holds “a direct or indirect participation of at least 75% of the capital of another or other dominated entities, provided this participation grants it more than 50% of voting rights.”

The new model targets companies within the same economic group, based on consolidating the tax balances to be delivered or recovered by group members.

Companies can choose to join this new regime, with the “dominant entity” responsible for exercising this option with the Tax and Customs Authority (AT), according to the legislative text. Should a group join, the new model then includes “all entities comprising the group.”

The entities within the group must meet several cumulative conditions.

They must “have a registered office or a stable establishment in national territory,” “conduct, wholly or partly, operations granting VAT deduction rights,” be “enrolled in the normal VAT system on a monthly basis at the time of opting in, or come under this regime” by the terms specified in the code, and “the controlled entity must be held by the dominant entity with the legally required participation level for over a year relative to when the regime starts to apply.”

This last condition excludes “entities constituted less than one year ago by the dominant entity or another entity in the group,” if since their establishment, there has been direct or indirect holding in line with financial linkage rules (75% of capital and more than 50% of voting rights).

The government explanation accompanying the proposal approved in parliament notes that consolidation occurs “in a VAT declaration made available by the Tax and Customs Authority and confirmed by the group member considered the dominant entity [the parent company of the economic group].”

Group companies “continue submitting their respective periodic declarations, calculating the respective balance, creditor or debtor, which is then reflected in the group declaration,” the government further explained.

When presenting the proposal, the executive considered the “experience gained in corporate group taxation” for corporate tax and “inputs obtained through the Forum of Large Taxpayers,” a dialogue group between the AT and major national companies.

The initiative was approved in a final global vote in the Assembly of the Republic on October 17, receiving support from PSD, CDS-PP, Chega, and IL. The PCP and BE voted against, while PS, Livre, PAN, and JPP abstained.

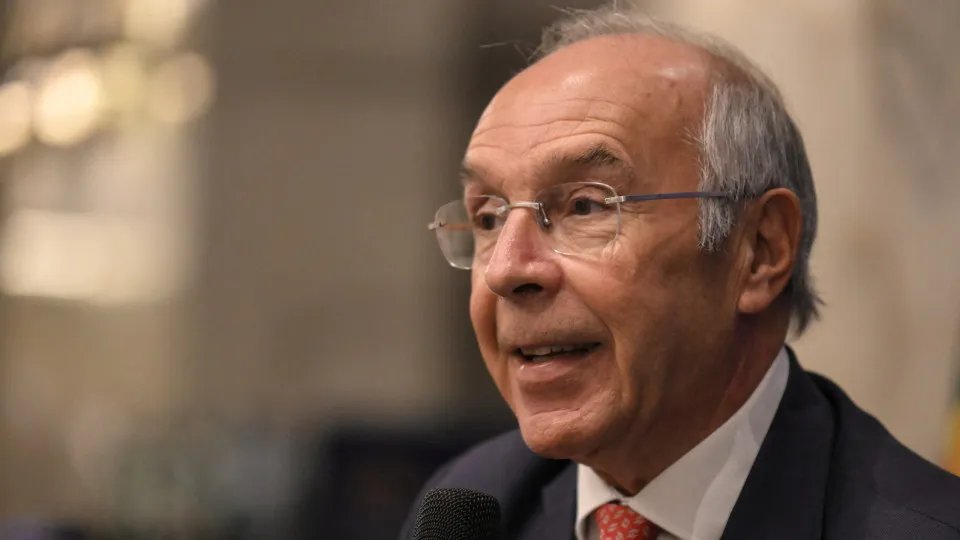

The bill was promulgated on the same day by President Marcelo Rebelo de Sousa.