The government has approved the proposal for the State Budget for 2026 (OE2026) at the end of last week, with the document set to be submitted to Parliament by Friday, October 10, following the presentation of the macroeconomic scenario to parliamentary parties by the Minister of State and Finance, Joaquim Miranda Sarmento.

The general debate on the government’s State Budget proposal for 2026 in Parliament is scheduled for October 27 and 28, with the final global vote set for November 27.

Before the general debate in the plenary, the government’s proposal will be presented by the Minister of State and Finance, Joaquim Miranda Sarmento, before the Budget and Finance Committee on October 24 at 10:00 AM. On the same day, in the afternoon, the Minister of Labor, Solidarity, and Social Security will also address the same committee. The plenary proceedings on the budget in its specifics will begin on November 20.

OE2026: What is Already Known?

Budget Already Includes Measures with a 4.449 Billion Euros Impact

OE2026 already includes a set of measures impacting public accounts, amounting to a total of 4.449 billion euros, according to the invariant policy framework submitted by the government to the Budget, Finance, and Public Administration Commission (COFAP).

Among the revenue-impacting measures is the reduction of Corporate Income Tax (IRC) by one percentage point, with an impact of 300 million euros, as well as updates to the specific deduction, IRS brackets, and the existence minimum, amounting to 325 million euros.

On the expenditure side, notable items include personnel expenses (1.248 billion euros), with the increase determined in the income agreement (512 million euros) and wage agreements (262 million euros), as well as pensions (1.563 billion euros).

Finance Ministry Expects Surplus This Year and Next

The government expects a budget surplus of 0.3% of GDP this year, and although no new forecasts for 2026 have been presented, a positive balance is still anticipated, with the last projections indicating a surplus of 0.1% in 2026, according to a report submitted to Brussels in April.

The Public Finance Council (CFP) continues to project a reduced budget deficit of 0.6% of GDP for next year, as per the published report, and the Bank of Portugal also forecasts a negative budget balance in 2026.

Regarding the macroeconomic scenario in the State Budget, the government had forecasted a growth rate of 2.1% for this year, which was revised to 2.4% in the report submitted to Brussels in April, with uncertainty remaining as to whether this estimate will be maintained.

Government Reduces IRS Rates

Parliament approved in July a reduction of IRS in 2025 and a commitment to a further reduction next year to be included in the State Budget for 2026 (OE2026).

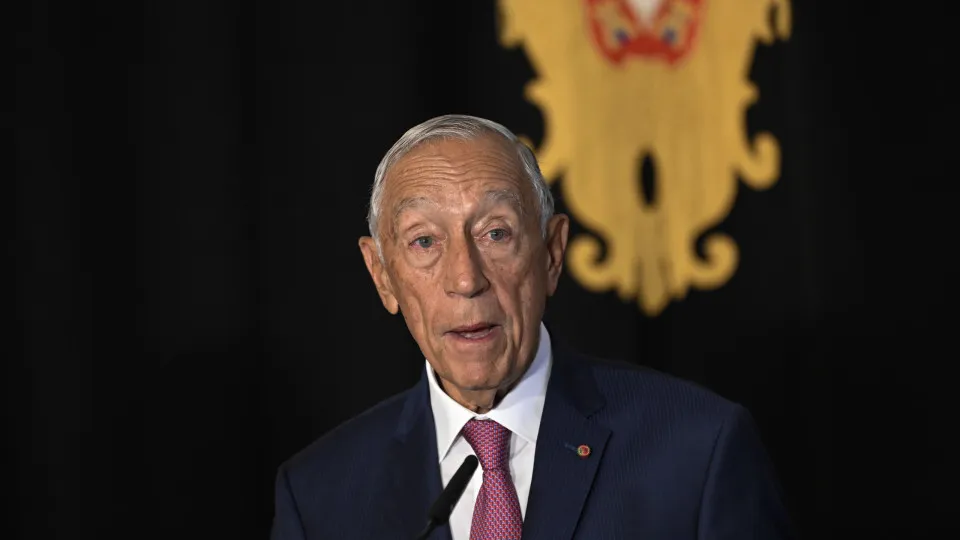

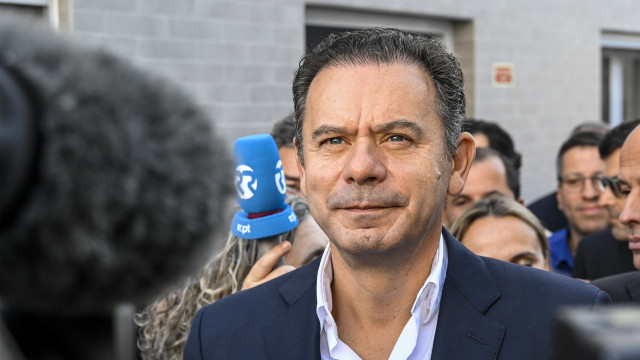

The president of PSD and prime minister confirmed today that the next State Budget will include further IRS cuts and expressed confidence in victory in Guimaraes, drawing on the results of the last legislative elections.

Lusa | 18:53 – 04/10/2025

The approved legislation includes a provision, added to the government’s initial proposal on the initiative of the PSD and CDS-PP parliamentary groups, requiring the government to propose in the “2026 State Budget” an additional reduction of 0.3 percentage points in marginal rates from the 2nd to the 5th bracket.

With this initiative, the executive is obligated by the Assembly of the Republic to advance a new proposal for IRS table reform, enacting a new rate reduction from the 2nd to the 5th bracket, affecting taxpayer income throughout 2026.

With an additional reduction of 0.3 percentage points, the second bracket would move to a rate of 15.7%, the third to 21.2%, the fourth to 24.1%, and the fifth to 31.1%.

Minimum Wage Increases to at least 920 Euros

The tripartite agreement on salary valorization and economic growth for 2025-2028, signed last October between the government, the four business confederations, and the General Workers’ Union, revised the trajectory of the national minimum wage upwards, projecting annual increases of 50 euros to reach 1,020 euros by 2028.

Consequently, the document indicates that the national minimum wage will rise from the current 870 euros to 920 euros in 2026.

In the government program, the executive set a new goal for the entire legislative term, aiming for the guaranteed minimum wage to reach 1,100 euros gross per month by 2029.

The Minister of Labor, Solidarity, and Social Security stated this week that the government is “neither opening nor closing the door” to revising the trajectory of the national minimum wage, which stipulates a rise to 920 euros in 2026.

IRC Reduction Outside the Budget

The reduction in the IRC rate was already approved in Parliament, in general, on September 19, ahead of the budgetary debate. Although the discussion occurs outside the main budgetary context, the fiscal impact of the measure is included in OE2026.

After a reduction in the IRC from 21% to 20% this year, the rate will decrease to 19% next year. For 2026, there is further relief for the rate applicable to Small and Medium Enterprises (SMEs) and companies with small and medium-capitalization on the first 50,000 euros of taxable income, from 16% to 15%.