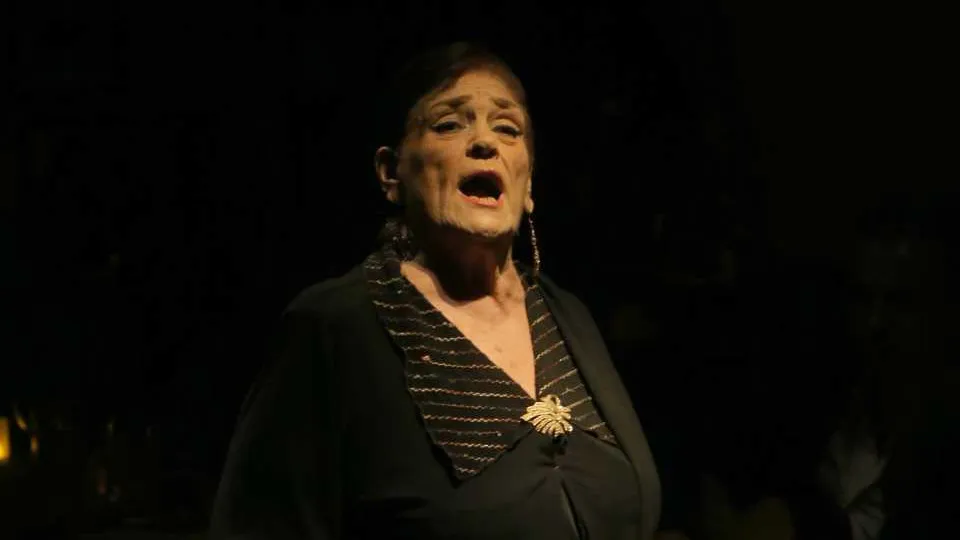

“The end of the takeover bid is the best path for Banco Sabadell and BBVA, as they are two major entities that generate more value apart than together,” stated Sabadell Chairman Josep Oliu in a statement.

“It is a great satisfaction to confirm that Banco Sabadell can continue on its own,” added Josep Oliu, noting the institution’s 144-year history.

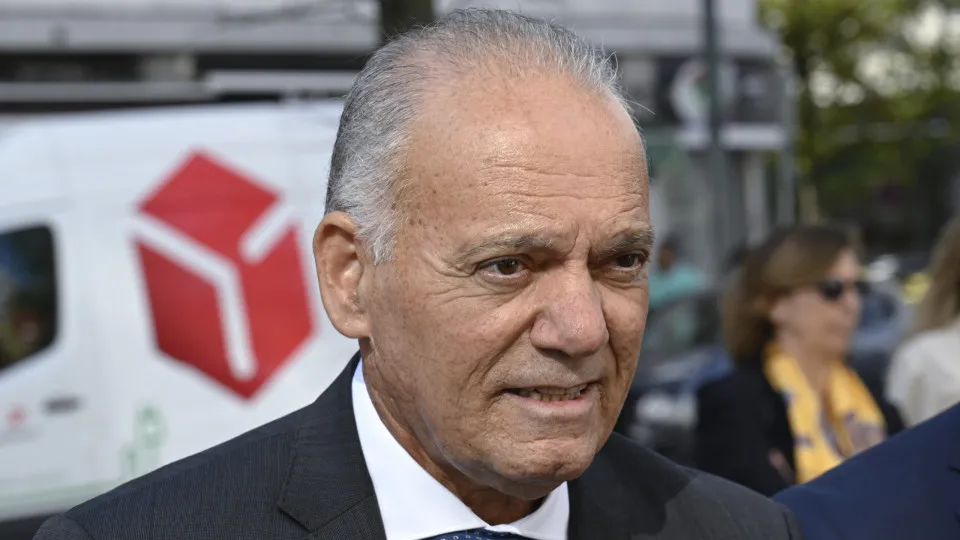

Sabadell’s CEO César González-Bueno, also quoted in the statement, remarked that the Catalan bank is a “project with a great present and an even better future independently.”

Following the conclusion of the takeover process and after the operation’s failure, Sabadell will proceed with its Strategic Plan 2025-2027, announced last July, “which envisages distributing 6.45 billion euros to shareholders and increasing profitability to 16% by 2027,” the Catalan bank disclosed in the statement released today.

BBVA, a Spanish bank originating from the Basque Country, failed to complete the hostile takeover bid for Catalan bank Sabadell, falling short of acquiring 26% of the financial institution’s capital, according to the Spanish National Securities Market Commission (CNMV) on Thursday.

The Basque bank BBVA obtained 25.47% of Sabadell’s capital, far from the initial goal of 50%, which would have granted it control over the Catalan bank.

The takeover bid had been formally underway since September 8, with BBVA offering one of its shares for every 4.8376 Sabadell shares, valuing each Catalan share at 3.39 euros—the highest value in over a decade.

The Basque bank had set a minimum requirement of gaining 50% of Sabadell’s capital. If it managed to acquire between 30% and 50%, it could maintain its participation but would be obliged to launch a second fully cash-based takeover bid, as opposed to the current share swap proposal.

Acquiring less than 30% would mean the total failure of the offer, which was confirmed.

BBVA’s attempt to merge with Sabadell aimed to create one of Europe’s largest banks, boasting approximately one trillion euros in assets, over 135,000 employees worldwide (including 19,213 from Sabadell), and more than 7,000 branches.

The new entity would have surpassed CaixaBank (BPI’s owner) in assets, becoming the second-largest bank in Spain, trailing only Santander.

Since the launch of the takeover bid in May 2024, the process encountered various regulatory challenges.

The market regulator approved the operation only in April of this year, and the Spanish government conditioned the merger on maintaining separate legal entities, assets, and managements of both banks for three years, with a possible two-year extension. Brussels initiated an infringement procedure due to the legislation that allowed the government to impose these conditions.

Apart from the Spanish government, the Catalonian regional government (both led by the socialists) also expressed reservations about the banks’ merger.

The takeover bid faced criticism from around 70 business associations and trade unions.