During remarks at the CNN Portugal International Summit in Alcobaça, the governor emphasized the critical role of the central bank as the nation’s macroprudential authority.

“Our duty is to ensure financial stability with policies that can prevent the real estate market from encountering difficulties like those witnessed in the past,” he stated. This was in response to some bank presidents expressing support for 100% mortgage financing.

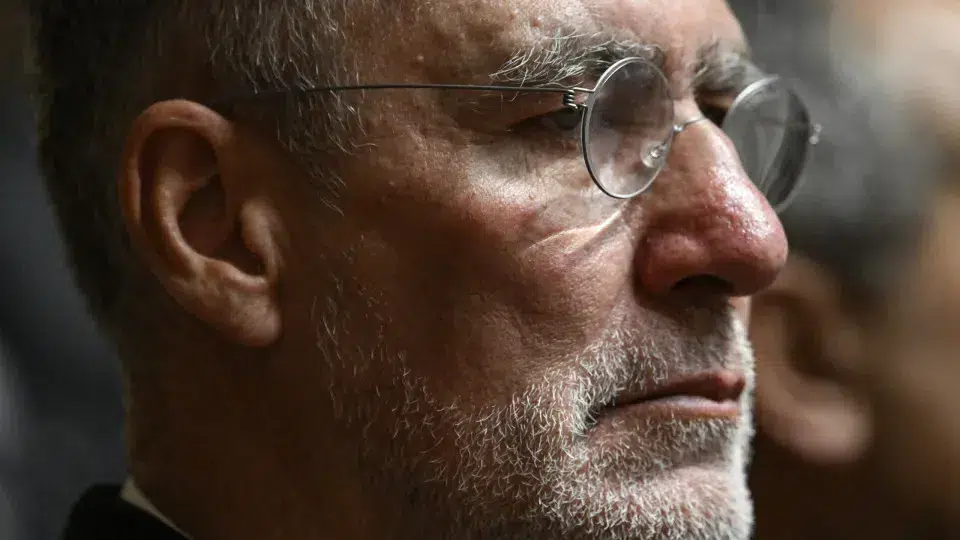

Álvaro Santos Pereira remarked, “In recent days, we have started hearing voices advocating for the relaxation of macroprudential rules, such as the down payment requirement for home purchases and other types of demands.”

The governor asserted that lessons from past mistakes should be heeded, suggesting that these individuals have not learned from previous errors.

“We clearly understand that macroprudential rules are crucial to ensuring future issues are avoided,” he argued, highlighting that in many European countries, “macroprudential rules,” meaning central bank recommendations, are becoming binding.

“For us, it is essential that these rules are adhered to. If these errors persist, the central bank will be ready to take action,” he assured.