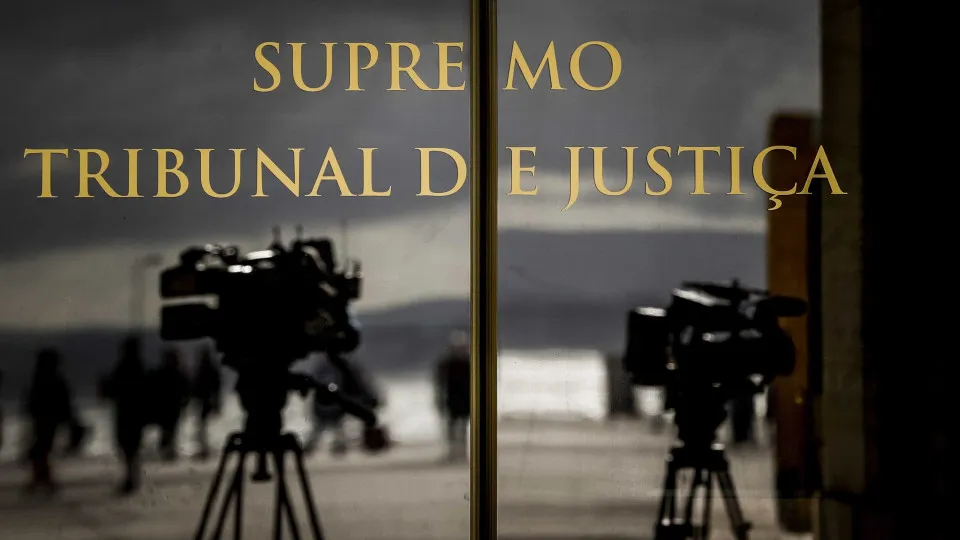

In two similar rulings, one from October 2024 and the other from May 2025, the Supreme Court evaluated the legality of “credit assignment” operations conducted by Banco Santander Totta and BPI on specific clients.

In both cases, the panels of judges concluded that the banks executed irregular sales, violating legislation that protects banking clients.

The deals were made by financial institutions with non-financial companies, resulting in clients losing protection under financial system rules from the point of credit sale.

The first case involved a mortgage sold by Santander to the Luxembourg-based company LC Asset 1 S.A.R.L. The second case concerned a credit sale by BPI to the company XYQ LUXCO S.A.R.L., also based in Luxembourg.

Although the Supreme Court decisions apply only to specific cases, they illustrate the practices followed by several banks in recent years, involving the sale of large portfolios of non-performing loans to entities linked to asset management funds. These funds, after acquiring the debt, work with collection companies to recover the money or take possession of properties from customers facing payment difficulties.

In the May ruling regarding BPI’s transaction, the court explained its reasoning for identifying a “fraud against the law.”

According to the panel of judges, if a loan taken for the purchase of a home is acquired by an entity not supervised by the Bank of Portugal, the operation is null because the contract becomes “excluded” from the protection enshrined in the legislation governing bank credits (Decree-Law No. 74-A/2017, of June 23).

The court stated that when a citizen is excluded from this regime, they lose the benefit of the “imperative norms” that protect them when facing “financial difficulty” or “default,” preventing them from exercising the so-called “right of redemption” under the contract, one of the rights enshrined in this decree.

The Civil Code allows banks to assign part or all of a credit to a third party, regardless of the debtor’s consent, provided the assignment is “not prohibited by law.”

Since Decree-Law No. 74-A/2017 characterizes as “fraud against the law” situations where contracts are “excluded from the scope of the decree,” the court deemed this was the case in BPI’s sale.

In the Supreme Court ruling, judges argued that if a client wanted to resume their loan, this could not occur because the purchasing company “cannot grant credit.” Concurrently, the credit institution could no longer facilitate this right.

The understanding was the same as in the October 2024 ruling concerning Santander.

BPI states that if clients wish to, they ensure this right by repurchasing the loan.

Similarly, Santander claims that the right is “not nullified due to the nature of the assignee entity.”

However, in both rulings, the Supreme Court emphasizes that the right is in jeopardy, stressing that selling the loan to an entity that is not a credit institution effectively “avoids or makes it more difficult (impossible) for the debtor” to exercise the right to resume payment in installments.

Meanwhile, new regulations in credit assignments are anticipated. Portugal is currently implementing a directive aimed at providing greater protection to clients, ensuring they do not end up in a worse situation than before the sale.