A recent report titled “Budgetary Evolution of Public Administrations in 2024” by the Portuguese Public Finance Council (CFP) revealed that the tax burden of Public Administrations, as measured by revenue from taxes and effective social contributions, increased by 0.1 percentage points of the Gross Domestic Product (GDP) in 2024, reaching 35.6% of GDP.

The report notes that “this increase resulted from the growth in the weight of indirect taxes and effective social contributions, which more than compensated for the decrease observed in direct taxes.”

Additionally, indicators measuring the weight of taxation on their respective bases increased: effective social contributions amounted to 22.1% of remuneration, corporate income tax (IRC) rose to 18.6% of gross corporate operating surplus, and VAT and IEC (Special Consumption Taxes) increased to 18.2% of nominal private consumption, reaching “historic highs of the past two decades.”

Conversely, personal income tax (IRS) on specific work income reduced its weight on remuneration to 8.8%.

The growth of non-tax and non-contributory revenue was influenced by a drop in capital revenue according to the CFP.

The increase in the sale of goods and services by Public Administrations (6.2%) and the favorable performance of other current revenue (11.9%)—explained about 80% by the increase in dividends and current revenue associated with the Recovery and Resilience Plan (PRR)—”more than compensated” for the decline recorded in capital revenue (-20.9%).

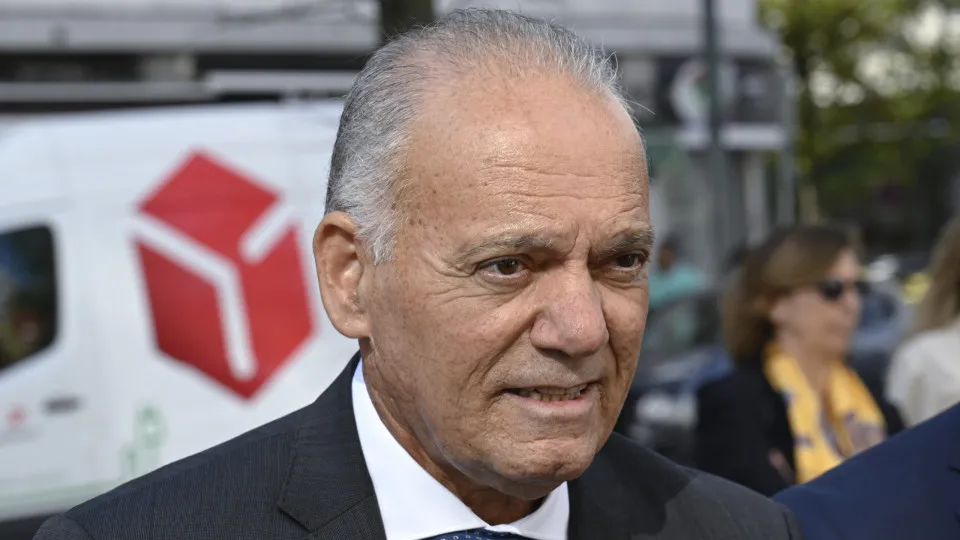

As per the body led by Nazaré da Costa Cabral, this decrease resulted mainly from the reduction in transfers of EU funds not related to the PRR, as the capital revenue received under this plan saw an increase of 16.8% (208 million euros).

Overall, public revenue grew by 6.3% in 2024, slightly exceeding the value projected in the State Budget for that year, “driven by the robustness of tax and contributory revenue, which together accounted for over 90% of the total growth.”

Despite the nominal growth in revenue, its weight on GDP remained almost unchanged (43.5%), reflecting an evolution in line with the nominal product.

Public expenditure accelerated in 2024 for the third consecutive year, increasing by 7.6% (+1.7 percentage points more than in 2023), partly due to higher execution of the PRR (without this effect, the expenditure increase would have been 7.0%).

In percentage of GDP, the weight of public expenditure rose from 42.3% in 2023 to 42.8% in 2024 (+0.5 percentage points), in a year “marked by the acceleration of the PRR and the approval of new permanent nature measures.”

This increase was attributed to the effect of the PRR (+0.3 percentage points of GDP) and also the denominator, as the growth of the nominal product (6.4%) was lower than that of public expenditure (7.6%).

Despite the growth in public expenditure, it was below the forecast in OE/2024.

The CFP notes that personnel expenses and social benefits “were responsible for more than 80% of the increase in primary current expenditure in 2024, raising its degree of rigidity.”