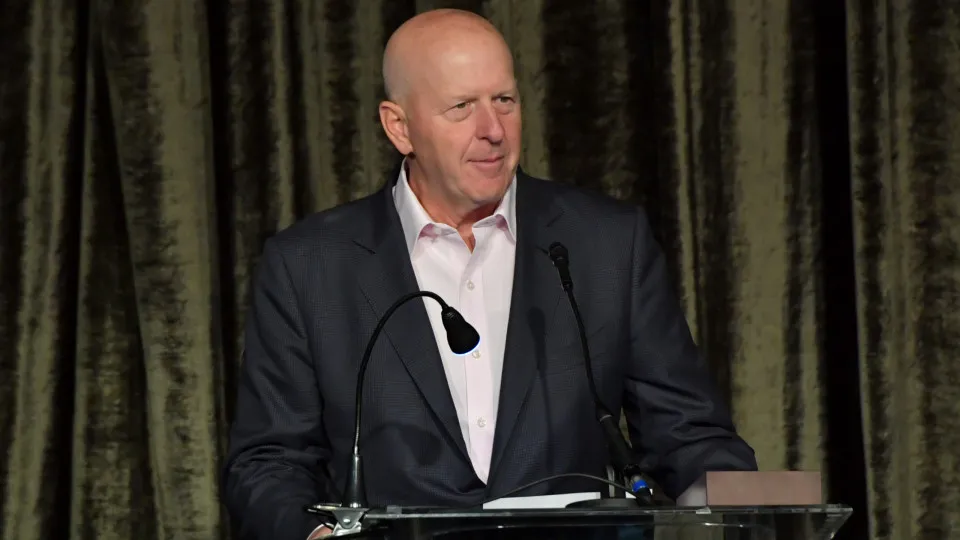

Expressing optimism about the future, the American banker anticipates economic growth acceleration by the end of 2026, driven by “very aggressive” fiscal stimulus measures and investments in new Artificial Intelligence (AI) infrastructures in the United States.

Although he warned of the challenges posed by new trade policies, still in the process of assimilation, which could affect a “somewhat more fragile geopolitical” world and impact growth and confidence, Solomon remains “optimistic,” expecting growth to accelerate by the end of next year.

“I believe that as trade policies are absorbed and technology spending continues, there will be good momentum,” he noted.

The CEO of Goldman Sachs highlighted the need to monitor the labor market, which is “a bit weaker.”

He also expressed confidence that the Federal Reserve (FED) is closely monitoring its evolution and that, in time, it will become clear whether the impact of trade policies on prices is just temporary or more significant.

“It is still too early to know,” he concluded.

The banker refrained from commenting on the FED’s potential future steps regarding interest rate adjustments, only stating that the balance between employment and inflation will “influence” whether there will be “one, two, or three more cuts” to rates.

Regarding the business climate, the Goldman Sachs CEO noted an increase in mergers and acquisitions, especially in the United States, driven by “a different regulatory environment.”

The banker advocated for the cyclical nature of markets, emphasizing that whenever new technology generates significant capital formation, leading to the creation of many new companies, the market anticipates the phenomenon.

“If we think about the Internet, Amazon was one of many companies that seized such opportunities; many disappeared, and Amazon became an incredible company,” he added.

Therefore, the Goldman Sachs CEO mentioned he wouldn’t be surprised “if in the next 12 to 24 months” there is “a market downturn.”

Solomon commented on the valuation of AI companies, abstaining from labeling it a “bubble,” but highlighted the enthusiasm that leads investors to focus on successes and overlook failures of the new technology.

“I am not smart enough to know, I think this will continue for some time. The opportunities are excellent and very exciting, but I also see complacency regarding risk-taking,” he warned.

Considering that we are still “at the beginning of the movie, not the end,” he stated that “there will be many winners and many losers.”

When the cycle closes, there will be significant capital invested that will have generated very attractive returns, but also much capital that will not generate returns, as happens in any major technology or investment cycle. “This time is no different,” he added.