The company announced to the London Stock Exchange that its pre-tax profits reached 2.113 billion euros, a decline of 0.38% compared to the same semester in 2024, while revenue increased by 7.3% to 19.609 billion euros.

Operating profit between April and September was 2.162 billion euros, down 9.2%.

The company also disclosed that the share buyback worth 3 billion euros is complete, with another 1 billion euros still pending.

The next tranche of 500 million euros starts today, they specified.

Cash flow decreased by 9.8% to 5.1 billion euros, while net debt rose, totaling 25.9 billion euros compared to 22.4 billion euros on March 31 this year.

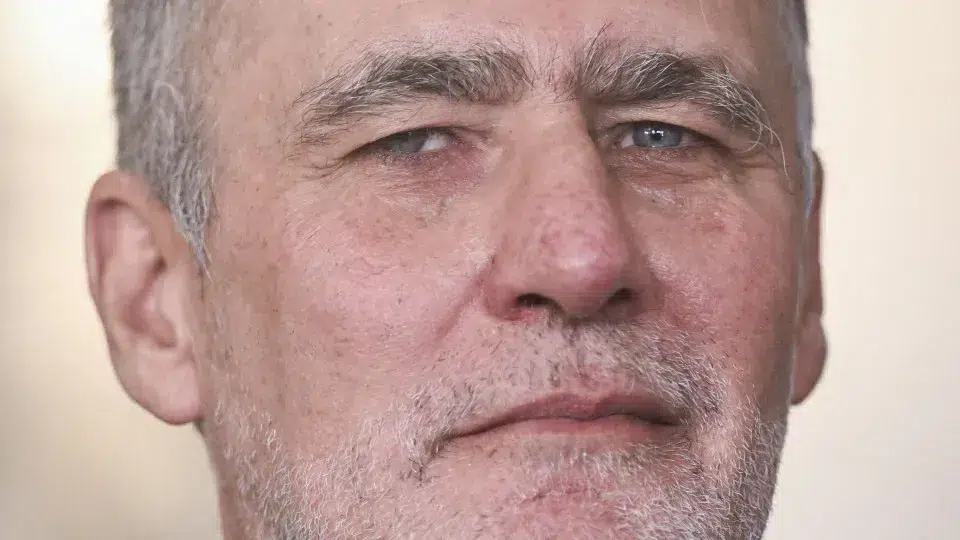

Vodafone CEO Margherita Della Valle stated, “Following the transformation progress, Vodafone has gained strong momentum. In the second quarter, we observed an acceleration in service revenue, with strong performances in the UK, Turkey, and Africa, and a recovery in growth in Germany.”

“Although there is more work to be done, we made good strategic progress in the first half, driving operational improvements across the company, expanding our customer satisfaction initiatives, and rapidly starting the integration of Vodafone and Three networks in the UK,” she added.