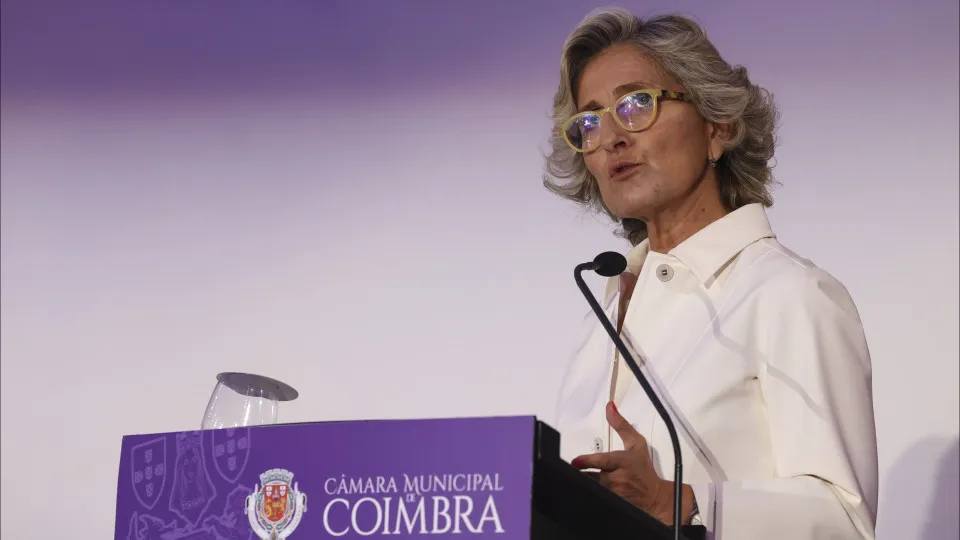

“We regularly share with the Angolan government and authorities what the financing options would be should they wish to formally request a program with the International Monetary Fund,” stated Victor Lledo, while presenting the Regional Economic Outlook for Sub-Saharan Africa with a focus on its Interrupted Recovery.

During the presentation today at the Faculty of Economics of Agostinho Neto University in Luanda, Victor Lledo mentioned to Lusa that the IMF also continues to provide capacity building to the Angolan government staff.

Regarding economic prospects, the expert noted that Africa and Angola began an encouraging economic recovery in 2024, transitioning from 3.6% in 2023 to 4% in 2024, with Angola accelerating its economic growth from 1% to 4.5% during this period.

This recovery was accompanied by a reduction in macroeconomic imbalances, such as inflation, public debt levels, and reserves, with greater exchange rate stability. This led to improved access to international markets, supported by “difficult economic policy measures,” including exchange rate flexibility and subsidy reductions.

“Unfortunately, this nascent recovery in both Africa and Angola risks being interrupted this year due to the current global scenario of escalating trade wars, which create uncertainties negatively affecting global growth prospects and commodity prices, including oil,” he stated.

The growth projections for this year, for the African continent and in particular for Angola, considering these effects, “should slow to 3.8% and 2.4%,” respectively, a situation “exacerbated by the decline in external aid.”

Victor Lledo emphasized the necessity to mitigate these external shocks with greater mobilization of domestic revenues, reforms to increase efficiency and transparency in public finance management, aiming to reduce the costs of external financing, and structural reforms to accelerate economic diversification and enhance the region’s commercial integration.

On the challenge of inflation in Angola, the IMF representative highlighted that the rate remains high but has shown a gradually “strongly declining” trend, moving “from a peak of 30% in July 2024,” with the latest data indicating “slightly above 22%.”

“Largely due to a restrictive monetary policy adopted by the National Bank of Angola, our stance is that this monetary policy is welcome and should continue until inflation demonstrates a decline to near single digits,” he stressed.

Regarding the withdrawal of fuel subsidies, Victor Lledo pointed out that subsidies “are extremely regressive and tend to benefit higher-income layers of the population,” consuming “necessary and fundamental fiscal space” for social protection and infrastructure expenses.

The Angolan finance minister stated last April that there will still be more cuts in transport subsidies this year, which have been happening gradually since 2023.

The official emphasized the importance of continuing this reform, stressing that additional fuel price increases should reflect improving conditions for the most vulnerable groups.

“What the Angolan government has done, alongside increasing fuel subsidies, is the expansion of the Kwenda [cash transfer program for vulnerable families]. It is very important for this situation to continue, not only in rural areas but also in urban areas, through this and other compensation modalities,” he noted.

Victor Lledo stressed the need for clear communication of these objectives and public finance management reforms to enhance fiscal transparency of resources, “very important to build general public confidence that money is being spent appropriately.”